The Future of Banking:

The Impact of Open Banking and API Integration

Table of Contents

Introduction

The development of electronic banking has gained high momentum since its inception several decades ago. Although the first activities relied on basic transactions and access by the customer to basic account information, this was a momentous change.

Technological improvements in recent years have significantly accelerated the digitalization of banking. Today, a banking application on a smartphone is a surprise to no-one. What's more, banking operations can now be performed from almost anywhere in the world.

Recent years have been marked by the development of open banking and a focus on the development of API integration. Industry focus on these activities has improved connectivity between financial institutions and third-party providers. This has resulted in new business models and revenue streams. Today, electronic banking has become an almost integral part of the banking experience for many customers. The convenience it offers and the control over resources have made it a popular choice in recent years. Modern banking institutions are making investments in the development of online banking using mobile devices, which makes them more adaptable to user requirements.

This e-book is intended as a response to the growing importance of open banking and API integration. As a FinTech application provider, we would like to outline what the future holds for the banking sector and show the challenges and opportunities that lie ahead for each of its institutions. Railwaymen has many years of experience working with FinTech companies. Our applications have repeatedly succeeded in revolutionizing client enterprises. In the presented material we will analyze the potential implications of open banking and API integration for the future of banking. We will take a closer look at the challenges and opportunities for financial institutions wanting to make the change.

We developed this e-book with the financial industry in mind. Whether you operate in banking, are in charge of accounting or deal with invoicing, the information we have included may inspire you to take the next steps in developing the services you offer. Learn about the future that awaits this sector and open yourself up to modern solutions that are capable of changing your current habits.

If you need supplemental information on what FinTech is, don't worry. Our company Railwaymen blog features an article titled "What is FinTech? An Introduction to the Financial Technology Industry." It's an excellent prelude to supplement the necessary information about the combination of finance and modern technology

Łukasz Młynek

CEO & Founder at Railwaymen

Open banking refers to the practice of allowing third-party providers to access banking data, with the customer’s authorization, in order to offer a wide range of financial services.

A note from our CEO

Dear Reader,

In today's digital age, banking is undergoing a significant transformation. The way we manage our finances has changed dramatically over the years and continues to evolve with constant surprises. This evolution is happening thanks to advances in technology and the emergence of novel solutions for managing our finances. One of the driving forces behind the changes taking place is the emergence and rise in importance of open banking.

Open banking refers to the practice of allowing third-party providers to access banking data, with the customer's authorization, in order to offer a wide range of financial services. This allows customers to have more control over their finances, make better decisions and have access to a wider range of services.

API integration, in contrast, allows different systems to communicate with each other and exchange data seamlessly. This has paved the way for a new era of innovation in financial services, where customers can now access services from different providers, all on one platform.

At Railwaymen, we believe that open banking and API integration is the future of the financial sector. That's why we're proud that the applications we develop are perfectly aligned with this trend and guarantee customers cutting-edge solutions to make their daily lives easier.

Our custom applications guarantee greater control over finances, allow you to make better decisions based on posted data and provide access to a wider range of services.

This e-book is intended as a comprehensive guide that explores the benefits and opportunities of open banking and API integration. I am confident that it will provide valuable insights and practical advice for companies looking to enter this new era of banking.

Enjoy the read,

Łukasz Młynek

1st

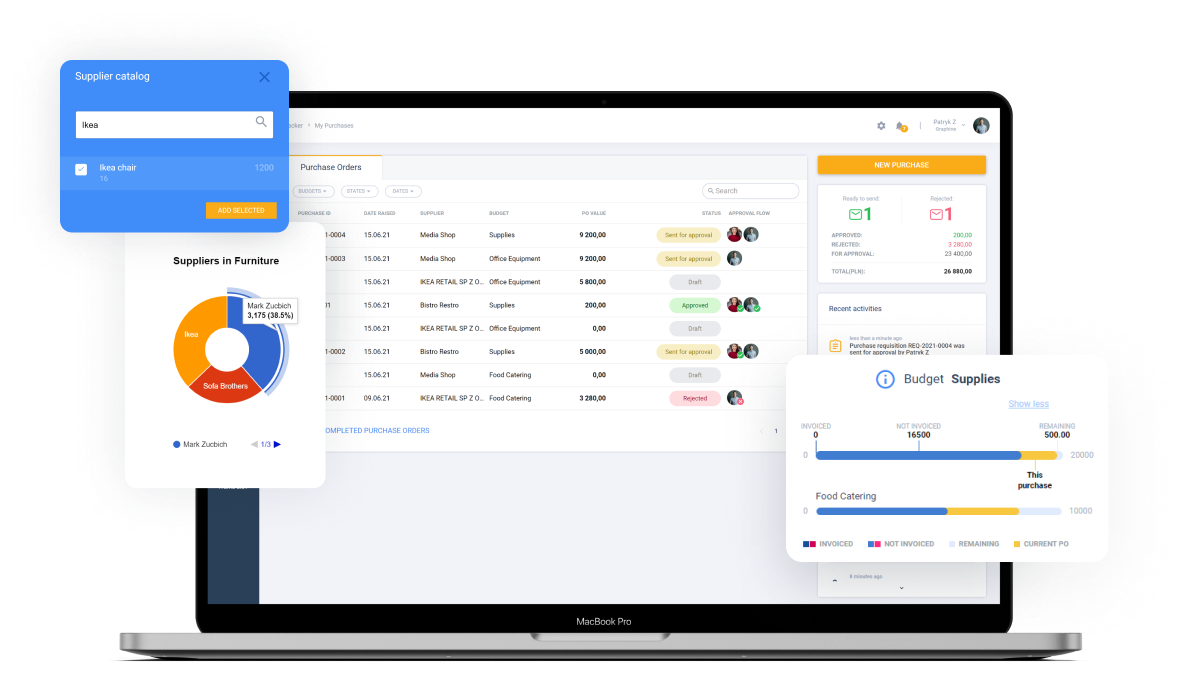

One of our FinTech solutions is now recognized as the world’s first blockchain technology idea platform

+3000

We created an order management solution that now handles more than 3,000 budgets

Worldwide expertise

For many years we have had a lot of successful cooperations with customers as far as 5,000 km away from our location

The future of banking

In the larger business community, making predictions about the future is often laughed off as fortune-telling. However, it is clear that the banking industry has been through major changes recently. Digitalization has given the development of banking a tangible boost. Traditional institutions are losing influence in favor of mobile applications which empower users with the ability to manage their finances from anywhere on earth. These trends raise both interest and concerns among users and entrepreneurs who must adapt to the new reality.

A Deloitte report on the future of banking in 2030 states that a lot depends on the direction the markets take now. To fit into the landscape of the 2030s, financial institutions will face increased pressure to take a number of actions. The company lists as many factors that are worth paying special attention to when preparing a business strategy for banking companies.

The key takeaways are:

Security against cyber risk and financial crime

Data integrity and analytics

Digital and emerging technologies

Embracing change and turning digital

Enterprise agility

Leveraging multi-platform integration

Monetizing data

Orchestrating influence on the new ecosystem

Due to the various types of regulations of the banking industry, most FinTech businesses focus on analyzing or transferring funds. In order to do so, it is necessary to cooperate with banking institutions to achieve access to accounts and transactions. Therefore, many companies bet on open banking combined with API integrations.

In the following chapters, we will introduce you to the concept of open banking and API integrations and prove how important they are for the current generation of financial solutions. In the later part of this document you will find examples of companies which made their digitalization goals, along with statements from their teams on how the change in approach to traditional services has affected the health of their businesses.

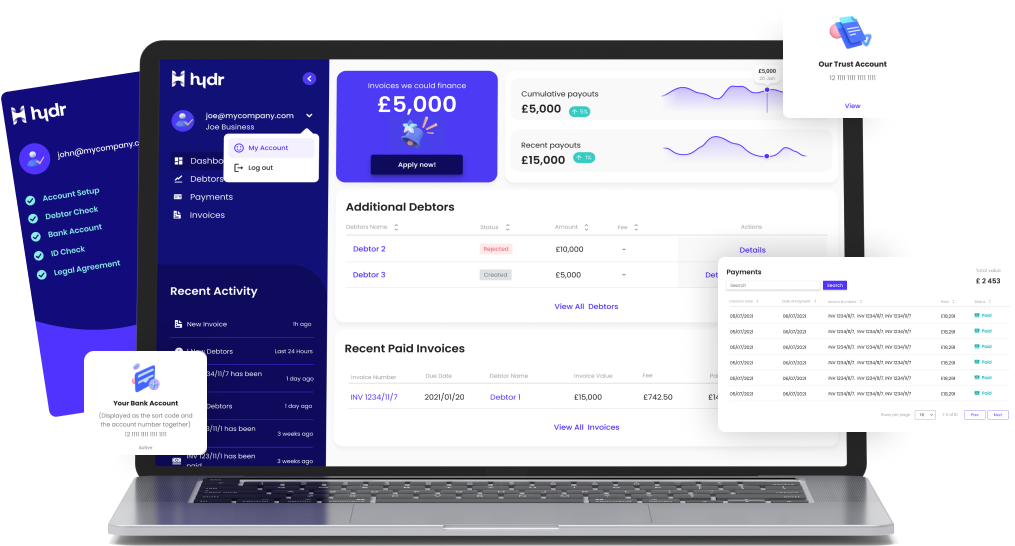

I am convinced that we will look back at the introduction of Open Banking in 2018 and recognise it as one of the most important moments for the FinTech community and the financial services sector as a whole. Open Banking presents remarkable and exciting opportunities for consumers and the business community – without it, we couldn’t deliver our core offering at Hydr.

Open Banking

Modern banking is changing under the influence of new technologies.

Until recently, banks were the sole owners of their customers’ private data related to finances or even marital status. Currently, based on the information collected about the customer, financial institutions can easily determine the habits of consumers and assign them appropriate behavior patterns. This data is used to personalize offers, as well as to make decisions on granting loans, credits and other financial services. A major step in the development of the realities of financial services as we know them so far has been open banking.

What is the purpose of open banking?

The mission of open banking is not only to make it easier for customers to access their financial data, but also to create a system that allows them to make the best choice in terms of available offers. The financial services industry can boost innovation and competitiveness by allowing customers to give consent to share their confidential data with third-party FinTech applications.

What is the main idea behind open banking?

The aim of open banking is to connect enterprise apps with banks so that users have more transparency in their spending. This system comprises thoroughly integrated services and is responsible for the development of financial products. As opposed to traditional banking, open banking makes use of the technological network of financial institutions to facilitate information exchange. The role of FinTech applications in the open banking system is to help users set budgets, allocate funds and coordinate accounts.

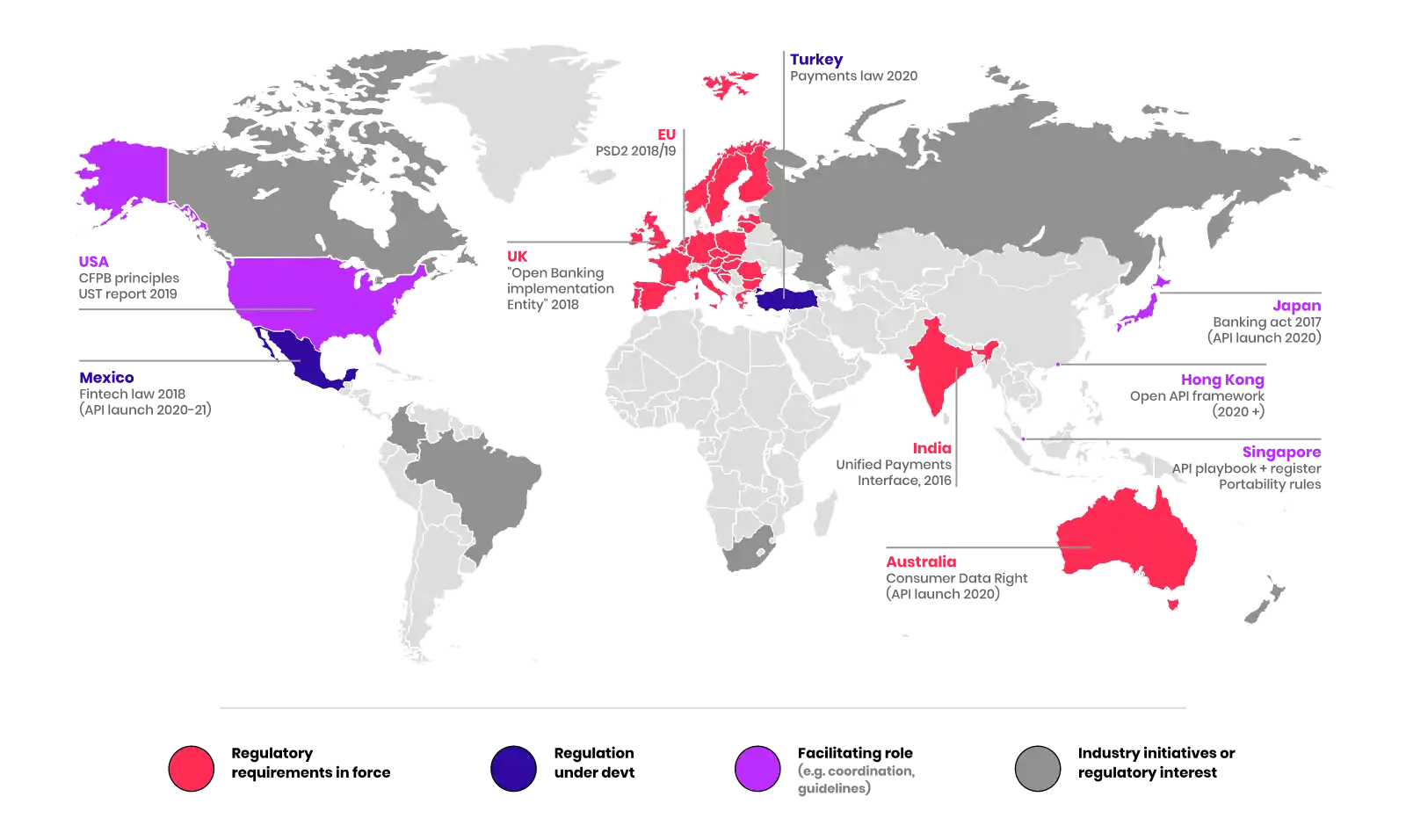

In many European countries, including the UK, open banking has already been introduced as a legal regulation and its implementation is under state supervision. The purpose of this is to ensure the security and confidentiality of customers’ financial data and encourage the development of the financial services market.

One example of the regulation is PSD2 (Payment Services Directive 2), which is in force in the European Union countries. This regulation enables bank customers to manage their finances more efficiently and proactively, increases the security of electronic transactions and stimulates the development of the financial services market. All this for the sake of consumer interests and stable economic development in Europe.

For more details about the PSD2 directive, please refer to the Railwaymen blog, where we posted the article “What is PSD2, and how does it affect the FinTech industry?”.

Is open banking a safe solution?

The procedure for opening accounts and obtaining bank statements is simplified, and the quality of all data gathered through open banking is checked to ensure that it complies with the highest standards. No operation on our account data can be performed without the customer’s express consent.

Banks and payment institutions are automatically required by regulations to use silent authentication, which means that when carrying out transactions, such as those made using mobile banking applications, the system may request extra authentication from the user. Customers may be required to authenticate by entering a pre-defined PIN code or by entering a single use code sent to their phone number. When it comes to the criteria connected to security, all banks are required to agree on and adhere to the same set of rules.

While the European Union has introduced the PSD2 Directive which regulates open banking, the process is still being adjusted for regulatory action in the United States. According to Forbes, 2023 could be a key year for sustaining open banking in the US. The condition is that an agreement is reached between all parties responsible for financial management standards.

.png)